Digital Marketing Services

Pay-Per-Click (PPC) advertising is an effective online marketing strategy utilized by tech businesses to increase their online visibility and drive targeted traffic to their websites. However, it is not uncommon for businesses to invest in PPC campaigns without achieving satisfactory…

Human Resources Consulting

In today’s fast-paced world, the technology sector has become one of the most dynamic and prosperous industries. However, even the tech niche is not immune to economic challenges. From market disruptions to global financial crises, businesses in the tech field…

Blog

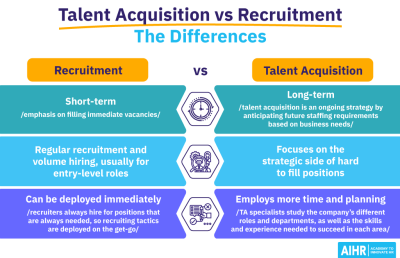

In today’s hyper-competitive tech industry, companies face immense pressure to attract and retain top talent. As technology continues to evolve at an unprecedented pace, organizations must employ innovative recruitment strategies to stay ahead in the game. This article will delve…

Blog

Employee engagement is crucial for the success of any organization. Engaged employees are more motivated, productive, and loyal to the company. In the increasingly competitive tech industry, it becomes even more vital to have effective strategies in place to keep…

IT Consulting and Solutions

In today’s fast-paced tech-driven world, businesses face numerous challenges when it comes to sustaining growth. However, with the right strategies in place, companies can ensure long-term success and thrive amidst fierce competition. This article will explore some effective strategies that…

Financial Consulting

In today’s highly competitive tech industry, establishing a strong online brand presence is crucial for success. With an ever-growing number of online platforms and digital communication channels, it is essential to carve out a unique identity that resonates with your…

Blog

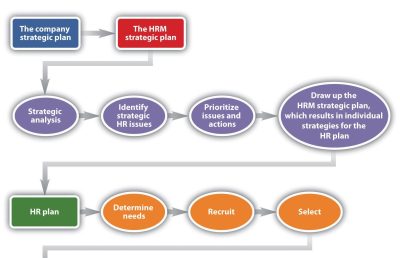

In today’s rapidly evolving tech landscape, human resources play a crucial role in determining the success of a business. Strategic HR planning is essential to align an organization’s workforce with its goals and objectives. By identifying talent gaps, developing a…

Blog

When it comes to running a successful business in today’s fast-paced digital landscape, having reliable and efficient IT support is a crucial component. It not only helps businesses navigate the complex world of technology but also ensures seamless operations and…

Blog

In today’s digital age, mobile apps have become an integral part of our lives. From shopping and banking to ordering food and booking rides, mobile apps have simplified various aspects of our daily routine. As businesses strive to stay ahead…

Human Resources Consulting

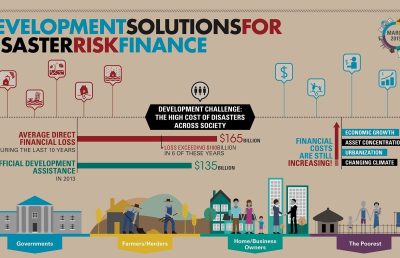

Financial forecasting is a critical aspect of any business, especially in the fast-paced and ever-evolving world of technology. In the tech niche, accurate financial projections are essential for making informed decisions, securing funding, and ensuring long-term success. This article explores…