Financial Health Check: Assessing Your Business Finances

In the fast-paced tech industry, assessments and audits are a common practice to ensure the optimal functioning of businesses. However, one crucial aspect that is often overlooked is the financial health of a company. Just like any other aspect of your tech venture, your business finances need to be regularly evaluated and assessed to identify areas of improvement and ensure long-term success.

Understanding the Financial Health Check

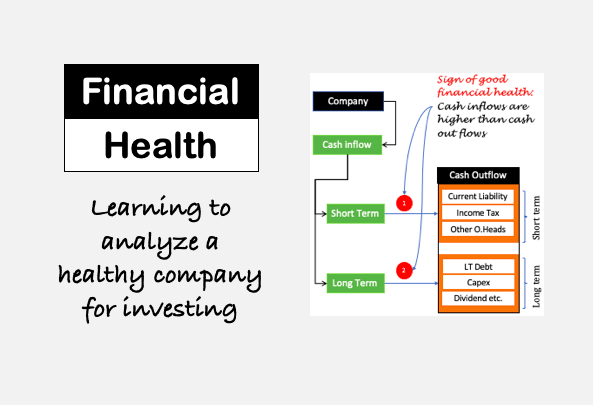

A financial health check is a comprehensive evaluation of your business’s finances to gauge its overall stability and sustainability. It involves analyzing various financial aspects, such as cash flow, profitability, liquidity, debts, and investments, to gain insights into the financial well-being of your company. By conducting this assessment, you can identify potential risks, make informed financial decisions, and design strategies for growth and expansion.

The Importance of Regular Assessments

Regular financial health checks are crucial for businesses operating in the tech industry. Given the rapidly evolving nature of the sector, businesses need to adapt and pivot quickly to stay competitive. Without a clear understanding of your financial situation, it becomes challenging to make informed decisions and allocate resources effectively.

By conducting regular assessments, you can spot early warning signs and address financial issues before they escalate. It enables you to identify wasteful spending, streamline costs, and optimize resource allocation. Moreover, financial health checks provide insights into the profitability of different areas of your business, enabling you to focus on high-revenue-generating activities.

The Key Elements of a Financial Health Check

When assessing your business finances, several key elements deserve attention:

1. Cash Flow Analysis:

Evaluating your company’s cash flow is crucial to understanding the inflow and outflow of funds. It helps identify periods of high and low cash balances, enabling you to plan and manage cash effectively. Regular cash flow analysis ensures you have enough working capital to cover expenses, pursue growth opportunities, and weather unforeseen circumstances.

2. Profitability Assessment:

Assessing your profitability is essential to understanding whether your business is generating sufficient profit from its operations. Analyzing key performance indicators (KPIs) such as gross profit margin, net profit margin, and return on investment (ROI) allows you to identify areas for improvement, cost optimization, and revenue enhancement.

3. Debt Evaluation:

Managing debts plays a vital role in maintaining financial stability. Evaluating your current debts, including loans, lines of credit, or outstanding bills, helps you gauge your leverage and develop strategies to minimize interest costs and improve debt repayment terms.

4. Liquidity Analysis:

Liquidity refers to your ability to meet short-term financial obligations. By assessing your company’s liquidity, you can identify potential cash shortages and take corrective actions. Calculating key liquidity ratios, such as the current ratio and quick ratio, provides insights into the availability of liquid assets to cover immediate expenses.

5. Investment Portfolio Review:

As a tech business, investments in research and development, infrastructure, and emerging technologies are crucial. Evaluating your investment portfolio ensures that you are allocating resources to the right projects with promising returns. It helps identify underperforming investments and redirects funds to more viable opportunities.

Getting Started: Conducting a Financial Health Check

To conduct a comprehensive financial health check, follow these steps:

1. Gather Financial Statements:

Collect your company’s financial statements, including income statements, balance sheets, and cash flow statements for the relevant period. Ensure you have accurate, up-to-date information to conduct a thorough evaluation.

2. Analyze Key Financial Ratios:

Calculate and analyze key financial ratios such as profitability ratios, liquidity ratios, and debt ratios. These ratios provide insights into your financial performance and highlight potential areas for improvement.

3. Review Cash Flow Patterns:

Analyze your cash flow patterns to identify any irregularities or seasonal fluctuations. Understanding your cash flow will help you identify risks and opportunities for better cash management.

4. Evaluate Debt and Credit:

Review your outstanding debts, credit terms, and interest rates. Explore opportunities to negotiate better terms or consider refinancing options to reduce interest costs.

5. Assess Investment Effectiveness:

Evaluate the performance of your past and current investments. Determine whether the returns are meeting your expectations and reallocate funds if necessary.

The Benefits of a Healthy Financial State

Assessing your business finances regularly and maintaining a healthy financial state brings numerous benefits:

1. Enhanced Decision-Making:

A thorough understanding of your financial health enables you to make informed decisions, such as investing in new technologies, hiring talent, or expanding operations. It reduces the risk of making financial decisions based on incomplete or inaccurate information.

2. Increased Investor Confidence:

A healthy financial state instills confidence in potential investors, lenders, and partners. Transparent financial reporting and a strong financial foundation can attract capital, partnerships, and favorable business relationships.

3. Improved Operational Efficiency:

Identifying financial inefficiencies allows you to optimize resource allocation, improve profitability, and streamline operations. You can identify which departments or projects require additional investment or cost-cutting measures.

4. Better Risk Management:

A robust financial health check helps identify potential risks and vulnerabilities, allowing you to take proactive measures to mitigate them. By staying ahead of financial challenges, you can safeguard your business against economic downturns and unforeseen circumstances.

Conclusion

Regularly assessing your business finances is essential in the tech industry. A comprehensive financial health check allows you to gain crucial insights into the performance, profitability, and stability of your company. It empowers you to make informed decisions, optimize resource allocation, and ensure long-term success in the rapidly evolving tech landscape. By dedicating time and effort to assessing your financial health, you set your business up for sustainable growth and competitive advantage.